In the evolving landscape of artificial intelligence, agentic RAG—Retrieval Augmented Generation—stands out as a groundbreaking integration of AI agents with enhanced retrieval capabilities, paving the way for smarter and more context-aware interactions between users and technology. The significance of agentic RAG spans beyond mere technical novelty; it introduces a paradigm where intelligent agents, powered by large language models and sophisticated vector databases, can dynamically retrieve and generate information, offering unparalleled precision and relevancy in responses. This innovation not only marks a leap in the capabilities of rag Langchain technologies but also establishes a new benchmark for agentic reasoning in intelligent systems.

As we delve into the complexities and advantages of agentic RAG, our discussion will encompass the various facets that distinguish it from traditional RAG, including the integration of AI agents like the ReAct agent and the use of technologies such as rag with Langchain and the LlamaIndex.

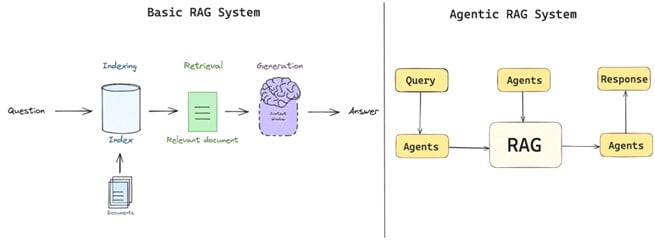

Differences Between Agentic RAG and Traditional RAG

Contrasting agentic RAG with traditional RAG offers valuable insights into the progression of retrieval-augmented generation systems. Traditional RAG, akin to basic search engines for AI, often struggles with complex questions and misses deeper contextual meanings, leading to responses that might not fully address user-specific needs. For instance, when asked about the environmental impact of solar panels, traditional RAG might provide general information on solar energy, overlooking specific details like the manufacturing process.

Manual Prompt Engineering

One significant advancement of agentic RAG over traditional RAG is its reduced reliance on manual prompt engineering. Traditional systems heavily depend on manual optimization techniques, which can be labor-intensive and less adaptable to changing contexts. In contrast, agentic RAG dynamically adjusts prompts based on the context and goals, demonstrating a higher level of intelligence and adaptability in handling queries.

Contextual Awareness

Furthermore, traditional RAG systems exhibit limited contextual awareness, often using static rules for retrieval that fail to consider the nuances of ongoing conversations. Agentic RAG, on the other hand, excels in understanding and integrating conversation history and contextual cues. This allows for more coherent and relevant responses, as if the system is actively participating in the conversation. By employing intelligent retrieval strategies, agentic RAG dynamically assesses the user’s query and contextual clues to decide the most appropriate retrieval action, enhancing the overall interaction quality and output relevance.

Types of Agentic RAG

Agentic RAG systems can be categorized into several types, each designed to enhance the interaction between AI and its users by leveraging specific capabilities. These include Routing Agents, ReAct Agents, and Dynamic Planning and Execution Agents.

Routing Agents

Routing Agents specialize in navigating through vast amounts of information to find the most relevant data in response to queries. They utilize advanced algorithms to efficiently sift through a vector database, ensuring that the retrieval process is both swift and accurate. This type of agent is crucial for applications where speed and precision are paramount.

ReAct Agents

ReAct Agents are designed to respond to changes in the environment or user input dynamically. They are capable of understanding context and modifying their behavior accordingly. This adaptability makes ReAct Agents particularly useful in scenarios where user interactions require a high degree of personalization and context-awareness.

Dynamic Planning and Execution Agents

These agents focus on planning and executing tasks by considering current goals and available resources. They are adept at formulating strategies that are not only effective in achieving the set objectives but also efficient in utilizing the resources. Dynamic Planning and Execution Agents are essential for complex problem-solving environments where multiple factors must be considered to make informed decisions.

How to Implement Agentic RAG?

Tools Needed

Implementing Agentic RAG effectively requires leveraging specific frameworks and tools that facilitate the creation and coordination of multiple agents. Key platforms include LlamaIndex, LangChain, and ZBrain by LeewayHertz. LlamaIndex offers a robust suite for constructing agentic systems, integrating seamlessly with databases and supporting advanced reasoning with Chain-of-Thought. LangChain provides a comprehensive toolkit that integrates with external resources, enabling sophisticated agent interactions. ZBrain distinguishes itself with a no-code, user-friendly environment, ideal for enterprises looking to deploy agentic RAG systems without extensive coding expertise.

Step-by-Step Process

Select the Appropriate Platform: Depending on your technical proficiency and specific needs, choose between LlamaIndex, LangChain, or others depending on your use case. Each offers unique features suited to different types of agentic RAG implementations.

Setup Document Agents: Utilize the chosen platform to create document agents. These agents are capable of performing tasks like question answering and summarization within their designated documents.

Implement Meta-Agent: Establish a meta-agent that oversees all document agents, ensuring they operate cohesively and efficiently.

Integrate External Tools and Resources: Connect your agentic system with external tools and databases to enhance its functionality. This could include linking with search engines, vector databases, and specialized APIs.

Test and Optimize: Once set up, test the system thoroughly to ensure it functions as intended. Optimize based on performance feedback to improve efficiency and accuracy.

By following these steps and utilizing the recommended tools, developers can implement an efficient and effective agentic RAG system tailored to their specific requirements.

Agentic RAG with LlamaIndex & LangChain

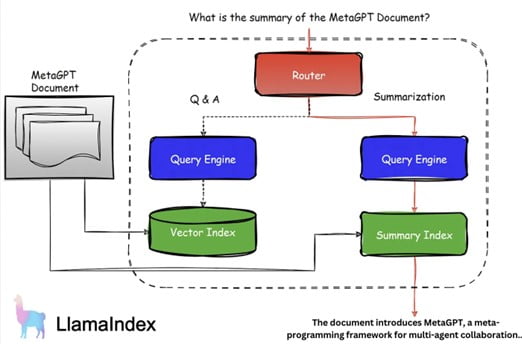

Agentic Retrieval-Augmented Generation (RAG) with LlamaIndex enhances conversational agents by integrating efficient data retrieval with advanced response generation. The process involves setting up LlamaIndex to index documents, which the RAG model queries for relevant information. A router directs the query to either the vector index for Q&A or the summary index for summarization, utilizing query engines to fetch the necessary data. This information enriches the generated responses, making them accurate and contextually relevant. Continuous evaluation and feedback loops further refine the system, ensuring a scalable, intelligent, and user-friendly interaction experience.

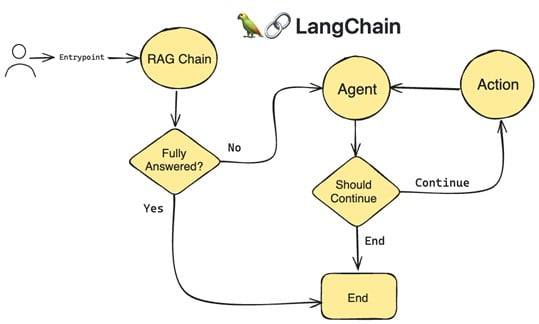

Agentic Retrieval-Augmented Generation (RAG) with LangChain enhances conversational agents by integrating advanced data retrieval with dynamic response generation. The workflow begins with user input entering the RAG Chain, which attempts to fully answer the query. If not fully answered, the query is passed to the Agent, which decides whether to continue processing. If continuation is needed, the Agent performs actions to gather more information or process tasks, and the cycle repeats until a satisfactory answer is generated. This loop ensures responses are accurate and contextually relevant, providing a scalable and intelligent user interaction experience.

Well, by now we should understand that the future is all about agentic RAG. Throughout this exploration of agentic RAG, we have traversed the intricate landscape of AI advancements, uncovering the complexities, advantages, and profound potential of integrating retrieval-augmented generation with intelligent agents. By comparing agentic RAG to its traditional counterpart, we have illuminated the considerable strides made towards creating more adaptable, context-aware, and user-specific AI interactions. The insights provided herein aim not only to equip readers with the knowledge to navigate this booming field but also to inspire further research and innovation, heralding a new era of intelligent systems that are more in tune with the nuanced demands of human interaction and inquiry.

Use Case: Real-Time Insights with Contextual Understanding for Hedge Fund Middle and Back-Office Operations

Traditional data platforms in hedge fund middle and back-office operations often rely on predefined workflows and static queries, making it difficult to manage real-time insights amidst continuously evolving market conditions and operational demands. This rigidity can lead to delays in trade reconciliation, risk reporting, and compliance management, particularly in fast-moving financial environments.

Agentic RAGs (Retrieval-Augmented Generative models) can overcome these limitations by constantly learning from diverse data sources and dynamically adjusting to the context of the data. This ensures that hedge funds can optimize critical back-office processes, such as portfolio accounting, settlements, and cash flow management, with timely and relevant data.

For example, in hedge fund operations, market conditions, compliance mandates, and portfolio adjustments are in constant flux. An Agentic RAG-powered data management platform can dynamically analyze trade discrepancies, counterparty risks, and liquidity profiles, integrating internal data from order management systems (OMS) with external data like market trends or even regulatory updates. This continuous, context-aware learning helps middle and back-office professionals make faster, more informed decisions to ensure smooth operational workflows.

The transformative potential of Agentic RAGs is realized through the integration of live data streams from both internal platforms, like portfolio management systems (PMS) and external market feeds. This creates a holistic view of operational health, enabling middle and back-office teams to take proactive actions, such as managing cash breaks or trade exceptions before they escalate into bigger issues. Rather than relying on after-the-fact data, operations teams can react instantly, improving the fund’s efficiency and responsiveness during critical periods like month-end or quarter-end reporting.

Here’s a step-by-step breakdown of how Agentic RAGs can catch a trade discrepancy in hedge fund operations:

1. Data Ingestion and Integration

- Agentic RAGs pull in data from multiple sources in real-time, including internal systems like the Order Management System (OMS), Portfolio Management System (PMS), trade blotters, and external data like market feeds, clearinghouse reports, and regulatory updates.

- It also integrates historical data for context, ensuring all relevant trade information is available.

2. Contextual Learning

- Agentic RAGs continuously learn from past trades, identifying patterns and understanding normal vs. anomalous behavior.

- The model builds a contextual framework of expected trade outcomes based on previous data and ongoing market conditions.

3. Real-Time Trade Monitoring

- As new trades are processed, Agentic RAGs monitor transactions in real-time, comparing each trade to expected patterns, past trade performance, and external market data.

- It checks for discrepancies such as incorrect trade details (e.g., mismatched volumes, incorrect prices), timing errors, or unusual patterns that don’t align with the market.

4. Discrepancy Detection

- Agentic RAGs use anomaly detection algorithms to flag irregularities. For example, if a trade is priced significantly above or below market price, or if there’s a mismatch in counterparty details, it’s immediately flagged as a potential issue.

- The model cross-references the trade with external sources like market feeds to ensure all data is accurate and up-to-date.

5. Real-Time Alerts

- Once a discrepancy is detected, Agentic RAGs send out instant alerts to the operations or risk management team, providing a detailed summary of the issue.

- Alerts may include what’s wrong (e.g., incorrect pricing, volume mismatch), possible reasons for the anomaly, and suggestions for next steps.

6. Contextual Recommendations

- Agentic RAGs don’t just flag the issue but also provide contextual insights. It might suggest potential causes, such as market volatility or incorrect trade entry, helping the team diagnose the problem more quickly.

- It can even compare the current discrepancy to similar past issues, offering recommendations on how to resolve it based on historical resolutions.

7. Resolution and Reporting

- Once the issue is identified, the back office team can take corrective actions such as correcting the trade details or escalating it to the relevant parties.

- Agentic RAGs also automatically log the incident and the resolution, creating a detailed report for future reference and compliance.