The future of AI in finance is unfolding rapidly, transforming how businesses manage operations, analyze data, and engage with stakeholders. A recent discussion between OpenAI’s CFO Sarah Friar and McKinsey senior partner Lareina Yee explored how generative AI is shaping finance functions and business leadership.

How Generative AI is Transforming Financial Operations

The future of AI in finance is already taking shape, with generative AI automating routine tasks and enhancing team capabilities. Key applications include:

Automating Financial Tasks with AI: Gen AI is streamlining processes like unifying data and coding accounts payable invoices, which reduces manual errors and increases efficiency. This automation not only accelerates workflows but also allows finance teams to allocate their time to more strategic initiatives.

AI-Powered Investor Relations: Custom GPTs are being developed to handle diligence questions from investors, allowing for quicker and more accurate responses. These AI-driven tools enhance communication with stakeholders, ensuring that inquiries are addressed promptly and effectively.

Skill Enhancement: Tools like ChatGPT assist team members in writing SQL queries, thereby enhancing their technical skills without extensive training. This capability empowers finance professionals to leverage data analytics more effectively, fostering a culture of continuous learning within the team.

Data Analytics and AI in Finance: Generative AI is also being utilized for data analysis and financial reporting, enabling teams to generate insights from large datasets rapidly. By automating the generation of reports, finance teams can focus on interpreting results and making informed decisions.

As the future of AI in finance continues to evolve, The future of AI in finance lies in a transition towards a more insight-driven function, where automation handles mundane tasks, freeing up human resources to concentrate on strategic analysis and decision-making. As generative AI continues to evolve, its integration into finance functions will likely lead to even greater efficiencies and innovations in the industry.

The Future of AI-Driven Finance

The future of finance lies in a transition towards a more insight-driven function. The aim is for generative AI to handle mundane tasks, freeing up human resources to concentrate on strategic analysis and decision-making. This shift not only enhances productivity but also fosters a culture of innovation within finance teams.

Leadership and Career Growth in AI-Driven Finance

Career Pathways in AI and Finance

Sarah Friar’s career trajectory—from Salesforce to Square, Nextdoor, and now OpenAI—illustrates the importance of adaptability and impact over mere titles. Her journey emphasizes:

- Impact Over Titles: Prioritizing roles that allow for significant contributions to organizational change.

- Key Capabilities: Essential skills for future leaders include problem-solving, strategic thinking, effective communication, and community building.

- Humanity in Leadership: Maintaining kindness and empathy is crucial in fostering strong team dynamics.

These insights are vital for emerging leaders navigating the complexities of modern business environments.

AI for Business and Government

Community and Democracy

AI’s role extends beyond business efficiency; it also enhances communication within communities. By reducing miscommunication, AI fosters trust and connection among individuals. For instance:

- Business Use Cases: Small businesses leverage AI for personalized marketing strategies, improving customer engagement.

- AI in Public Services: AI aids governments in personalizing communication with citizens, enhancing transparency and responsiveness.

These developments illustrate how AI can bridge gaps between businesses, governments, and communities.

Cutting-Edge AI Innovations in Financial Services

AI-Driven Business Innovations

Several companies are pioneering innovative uses of AI in their operations:

- Morgan Stanley employs AI for knowledge management, enhancing client communication.

- Klarna has developed a digital shopping system that improves customer service through intelligent automation.

- Mercado Libre utilizes autonomous systems for customer service management, streamlining support processes.

- Square aims to transform inquiries into commerce through advanced AI solutions.

These examples highlight how organizations are integrating AI to enhance operational efficiency and customer experience.

How Agentic AI is Revolutionizing Business Automation

The introduction of reasoning capabilities in AI models marks a significant advancement. This technology enables AI systems to make informed decisions based on complex datasets, contributing to innovation across various sectors.

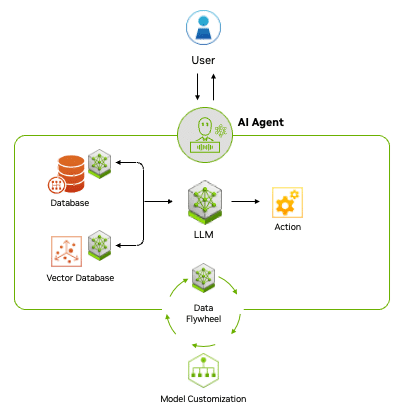

Image credits: NVIDIA

Agentic AI represents a paradigm shift from traditional AI by incorporating autonomous decision-making and goal-oriented behavior. Unlike conventional models that merely execute predefined tasks, agentic AI can plan actions, learn from experiences, and adjust strategies in real-time based on new information. This enhanced autonomy allows these systems to operate with minimal human intervention, making them ideal for dynamic environments where rapid decision-making is crucial.

Moreover, agentic AI employs a “chaining” capability, breaking down complex tasks into manageable steps. For example, when tasked with creating a website, an agentic AI system can autonomously generate a series of goals and execute them sequentially. This capability not only improves efficiency but also fosters innovation by enabling organizations to tackle challenges in novel ways. As businesses increasingly adopt agentic technology, we can expect significant improvements in operational efficiency, adaptability, and personalized solutions tailored to individual user needs.

Improving Ways of Working with Gen AI

Enhancing Workplace Collaboration with AI

The future of AI in finance is driving new workplace dynamics, especially through the integration of multimodal communication tools.

Generative AI for Scenario Planning: AI can facilitate scenario analysis, helping teams evaluate potential outcomes quickly. This capability allows finance professionals to model various financial situations, such as changes in market conditions or shifts in consumer behavior, enabling them to prepare for uncertainties effectively.

AI-Driven Decision Making: By providing real-time data insights, AI supports informed decision-making processes. With the ability to analyze vast amounts of data rapidly, finance teams can identify trends and make strategic decisions based on comprehensive analyses rather than relying solely on historical data.

Increased Collaboration: AI tools promote collaboration across departments by synthesizing data from various sources, allowing finance professionals to work more closely with marketing, operations, and sales teams. This interconnected approach ensures that financial strategies align with broader business objectives.

Continuous Learning and Adaptation: As AI systems learn from new data inputs, they continuously improve their predictive capabilities. This adaptability enables finance teams to refine their strategies over time, responding agilely to market changes and internal performance metrics.

These changes suggest a future where finance professionals can leverage technology to optimize their workflows significantly. By embracing generative AI, organizations can enhance their operational efficiency and foster a culture of innovation that drives long-term success in an increasingly complex business environment. As AI technologies continue to evolve, they will empower finance teams to not only react to changes but also proactively shape their strategic direction.

Ladies Who Launch

Inspiring the Future of Women Entrepreneurs in Finance and AI

The initiative “Ladies Who Launch” focuses on empowering women and nonbinary small business owners through grants, mentorship, and networking opportunities. Key lessons learned from this initiative include:

- Community Importance: Building supportive networks is crucial for entrepreneurial success.

- Practical Education: Providing hands-on learning experiences fosters growth among women entrepreneurs.

These insights underline the value of collaboration and shared experiences in driving entrepreneurial success.

How AI Can Shape a Successful Finance Career

Networking Strategies for Women in AI and Finance

Sarah Friar encourages young women to embrace risks and actively network. Key pieces of advice include:

- Take Risks: Stepping outside comfort zones can lead to significant opportunities.

- Build Connections: Networking is essential for career advancement; making requests can open doors.

Additionally, Friar shares her personal preferences, such as her morning routine that emphasizes teamwork and discipline—qualities she attributes to her background in rowing.

Conclusion

The transformative potential of AI in finance is profound. As organizations increasingly adopt generative AI technologies, they stand to gain not only operational efficiencies but also enhanced strategic capabilities. The emphasis on community, kindness, and strategic thinking will be pivotal in driving meaningful change within organizations. As we look toward the future, it is clear that embracing these technologies will be essential for finance professionals aiming to navigate an increasingly complex landscape while fostering inclusive growth across communities.