Boost your Productivity by 40% with AI-Powered Intelligent Process Automation

Optimize financial reporting and compliance with AI-driven automation. Seamlessly integrate advanced automation with your trusted systems to reduce errors, accelerate operations, and enhance client satisfaction.

Trusted By

Navigating Key Challenges

Process Overload

Managing complex, high-volume tasks in compliance, KYC, and regulatory reporting creates bottlenecks and reduces efficiency

Manual Task Burden

Repetitive tasks like approvals, data entry, and client onboarding consume resources, slowing responsiveness and service delivery.

Decision-Making Delays

Manual processes in portfolio reporting, compliance checks, and client services hinder timely decisions, affecting client outcomes and agility.

Operational Errors

Manual handling of financial data and regulatory documents increases the risk of costly mistakes, non-compliance penalties, and reputational damage.

Employee Burnout

Staff overwhelmed by repetitive tasks in documentation, report generation, and auditing experience burnout, limiting focus on high-value advisory roles.

Inflexibility to Market Changes

Manual processes reduce agility, making it difficult to adapt quickly to new regulations or shifts in client demands.

metrics

Manual data extraction tasks eliminated

0

%

Improvement in workflow productivity

0

x

Reduces data entry errors

0

%

Simplify Complex Workflows with Intelligent Automation

Benefits

Workflow Automation

Streamline client management, compliance, and finance to eliminate repetitive tasks, enabling advisors to focus on impactful client interactions.

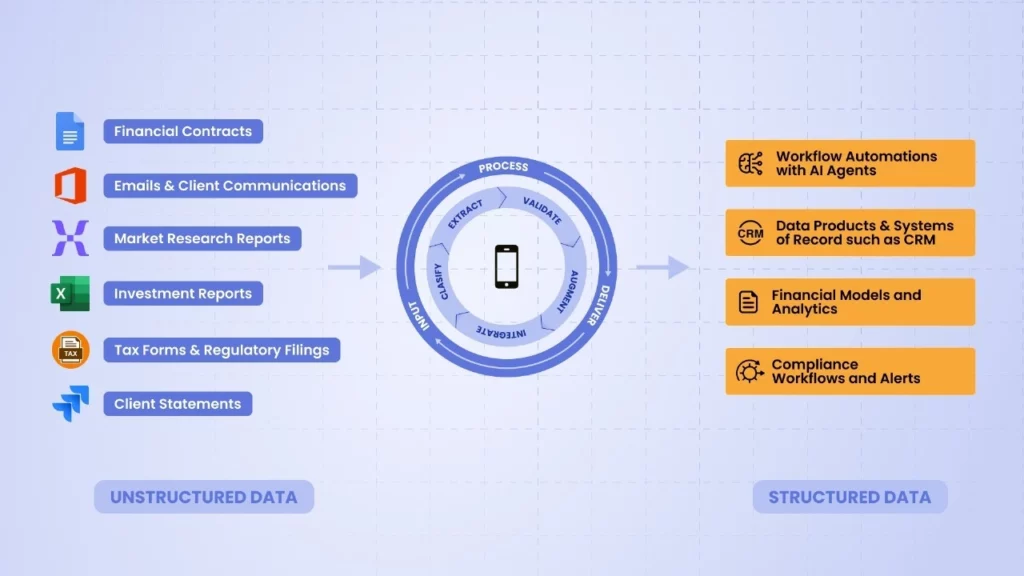

AI Data Processing

Extract and categorize financial data from multiple sources, reducing data entry time and minimizing errors.

Finance and Compliance Automation

Automate KYC, client onboarding, compliance checks, and portfolio management, allowing staff to concentrate on client service and strategic decisions.

Anomaly Detection

Identify and resolve data inconsistencies in real-time to ensure compliance and reduce financial risk.

AI Optimization

Enhance process accuracy and efficiency through real-time feedback, adapting to evolving compliance and reporting needs.

Platform Integration

Integrate with ShareFile, SharePoint, OneDrive, Google Drive, and other systems to unify compliance and client data management.

Case Studies

Frequently Asked Questions

IPA is designed to optimize high-frequency, high-value workflows such as compliance checks, KYC, client reporting, and data reconciliation, allowing staff to focus on advisory and client-facing roles, which boosts productivity and client satisfaction.

Yes, our IPA solutions follow stringent financial industry standards, ensuring end-to-end encryption and data privacy compliance, safeguarding client and organizational data.

Absolutely. Our IPA platform is built to adapt to your specific workflows, including client onboarding, regulatory reporting, compliance monitoring, and more, allowing customization to meet your exact requirements.

We provide comprehensive support to ensure seamless operation, continuous optimization based on your feedback, and adaptation to regulatory changes, ensuring your automation processes remain accurate and compliant.