Introduction

Financial firms face increasing challenges in managing compliance due to fragmented data, manual workflows, and a complex regulatory landscape. Traditional methods no longer meet the demands for accuracy, efficiency, scalability, and security.

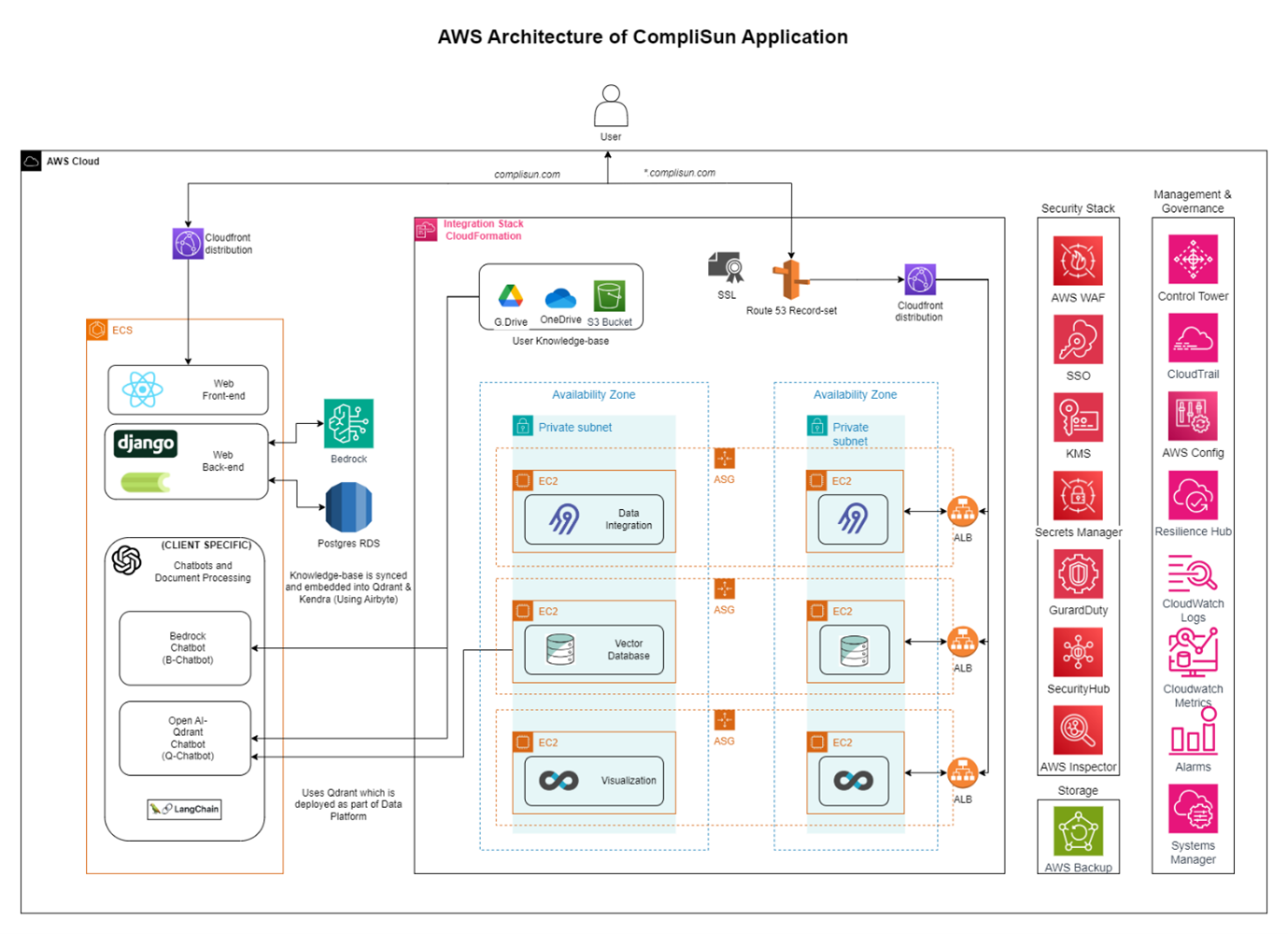

CompliSun, an AI-powered compliance platform built on AWS, automates workflows, integrates systems, and ensures robust security. With its advanced AWS technologies, CompliSun offers a centralized, scalable solution to help financial firms manage compliance seamlessly.

Challenges: Managing Complexity and Scaling Operations

Financial firms faced several critical challenges that hindered their compliance efforts:

- Fragmented and Inefficient Compliance Processes: Many financial firms rely on outdated, manual workflows and disconnected systems, leading to inefficiencies, errors, and delays in maintaining compliance.

- Constantly Evolving Regulatory Landscape: Financial institutions struggle to keep up with the rapidly changing regulatory environment, making it difficult to stay compliant and avoid penalties.

- Vendor Risk Management: Managing third-party vendors and continuously assessing risks, especially with manual processes, is time-consuming, prone to errors, and difficult to scale.

- Lack of Scalable Compliance Solutions: Traditional compliance tools fail to scale as organizations grow, making it hard to manage increasing volumes of regulations, policy updates, and compliance tasks effectively.

- Data Tracking and Reporting Challenges: Firms often face difficulties tracking compliance data accurately across multiple systems, which leads to fragmented records, inefficiencies, and challenges in reporting or audits.

- Slow Adaptation to Regulatory Changes: Without an agile solution, financial firms struggle to integrate new regulatory changes quickly into their workflows, leaving them exposed to compliance risks.

The Solution: AI-Powered Compliance Management with Robust Guardrails

CompliSun was designed to address these challenges by providing a centralized, AI-powered compliance platform, underpinned by a security-first architecture built on AWS. CompliSun integrates RAG with agentic tool-calling to manage evolving regulatory requirements and automate compliance operations. The system uses Amazon Bedrock Titan Embeddings for semantic retrieval from policies, regulatory updates, and internal knowledge bases. Claude models via Bedrock enable contextual understanding, summarization, and compliance response generation. AI agents support use cases such as automated policy creation, vendor risk monitoring, and regulatory change tracking—streamlining compliance workflows with high accuracy and adaptability.

Key Features and Capabilities:

- Centralized Compliance Management: Automated workflows streamlined compliance checks, issue tracking, and reporting, with real-time alerts for proactive monitoring and a dynamic policy generator for easier policy creation and management.

- Vendor Risk Monitoring: AI-powered assessments provided real-time vendor risk alerts, including negative news and scoring, with customizable risk modules tailored to organizational priorities and regulatory requirements.

- Regulatory Change Management: Automated updates integrated directly into workflows, ensuring seamless adaptation to new regulations, while transparent audit trails provided full visibility and accountability.

- AI-Enhanced Compliance Chatbots: Intranet-integrated chatbots simplified compliance queries, automated data collection, and provided real-time insights, while tracking and logging key metrics for ongoing monitoring.

Technical Architecture

CompliSun leverages a powerful AWS stack and other advanced technologies to deliver seamless compliance management:

- AWS Bedrock: Powers AI-driven compliance workflows, providing a scalable and integrated foundation.

- AWS Lambda: Enables serverless, event-driven workflows that trigger real-time compliance alerts.

- AWS GuardDuty & Security Hub: Centralized security monitoring to detect misconfigurations and anomalies, ensuring proactive threat response.

- AWS CloudTrail & VPC Flow Logs: Comprehensive tracking of API activity and network traffic for audit trails and anomaly detection.

- Amazon S3: Secure, scalable storage for compliance documents and logs, with encryption managed by AWS KMS.

- CloudFormation and AWS CodePipeline: Automates infrastructure provisioning and streamlines deployment processes.

- React/Django: Powers the frontend of the platform, offering a responsive and intuitive user interface.

- Vector DB: Efficiently stores and retrieves data, enabling contextual understanding and quick data processing.

- Visualization: Provides advanced visualization capabilities for compliance metrics, trends, and reports.

- Flexibility with LLM Providers: Supports integration with leading Large Language Model (LLM) providers like Amazon Bedrock, Hugging Face, Anthropic Claude, and OpenAI GPT for advanced regulatory text analysis and contextual insights.

- Security Architecture: A dedicated VPC-per-client model ensures strict tenant isolation, while AWS Control Tower enforces centralized governance, least-privilege access, and multi-factor authentication (MFA). Fine-grained IAM policies and service control policies (SCPs) reduce attack surfaces and ensure secure access management.

Impact: Measurable Results for Financial Firms

The implementation of CompliSun delivered significant benefits to financial firms:

- Improved Compliance Accuracy: Automated workflows reduced errors, ensuring adherence to complex global regulations.

- Streamlined Operations: Centralized workflows and automated processes reduced compliance processing time by 40%, enabling teams to focus on strategic tasks.

- Enhanced Scalability: AWS infrastructure scaled effortlessly with growing data volumes, ensuring consistent performance and cost efficiency.

- Accelerated Vendor Risk Management: Continuous AI-powered assessments cut due diligence time by 30%, enabling faster vendor onboarding and risk mitigation.

- Advanced Security: Multi-layered AWS security features ensured robust data protection and compliance with regulatory standards.

- Actionable Insights: Interactive dashboards and visualizations provided real-time insights into compliance metrics, vendor risks, and audit readiness.

Conclusion: Simplifying Compliance with CompliSun

CompliSun helps financial firms tackle complex regulations, fragmented data, and scalability issues by automating compliance workflows, integrating systems, and leveraging AWS’s secure infrastructure. With AI-driven capabilities, flexible architecture, and robust security, CompliSun enhances compliance accuracy, operational efficiency, and scalability.

Next Steps: Transform Compliance Operations with CompliSun

Facing challenges in compliance management, vendor risk, or regulatory adaptation? CompliSun can help. Contact us to learn how our AI-powered platform can transform your operations.

Contact Us –

- Email: engage@digital-alpha.com

- Phone: +1 609-759-1367