The financial markets are notoriously complex, influenced by a myriad of factors ranging from company fundamentals to global events. Traditional algorithmic trading systems, often reliant on quantitative models, have struggled to fully capture the complexity of AI Trading. However, recent advancements in Large Language Models (LLMs) have opened new avenues for creating more sophisticated and adaptable trading systems. A groundbreaking research paper introduces TradingAgents, a novel framework that leverages the power of LLMs in a multi-agent system to simulate a real-world trading firm, offering a glimpse into the future of AI-driven finance.

Multi-Agent System in AI Trading

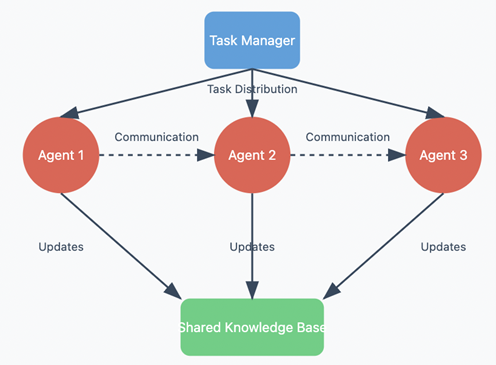

A multi-agent system involves multiple autonomous agents that interact with each other to achieve individual or collective goals. These agents can have different roles, capabilities, and objectives, and their interactions are essential for the system’s overall function.

The AI Trading framework, like TradingAgents, uses a variety of agents to simulate a real-world trading firm.

Here’s a more detailed breakdown of key concepts:

Specialized Roles: In a multi-agent system, agents typically have specific roles and responsibilities. For instance, TradingAgents includes fundamental analysts, sentiment analysts, technical analysts, and traders. Each of them focusing on a different aspect of the trading process. This division of labor enables the system to handle complex tasks by breaking them into smaller, more manageable parts.

1. Collaboration: Agents in a multi-agent system need to interact and collaborate to achieve their objectives. In TradingAgents, for example, analysts gather market data, researchers evaluate it, traders make decisions, and risk managers oversee the process. These interactions can take the form of structured communication, natural language dialogue, or a combination of both.

2. Communication: Effective communication between agents is crucial for the success of a multi-agent system. In TradingAgents, the system uses a structured communication protocol that combines structured documents with natural language dialogue. This hybrid approach ensures that information is clear, concise, and well-organized, reducing the risk of information loss and misinterpretation.

3. Debate and Reasoning: Multi-agent systems can utilize debate and reasoning among agents to improve decision-making. The TradingAgents framework uses bullish and bearish researchers to debate the merits of investment decisions, ensuring a balanced perspective. The risk management team also engages in debate from risk-seeking, neutral, and risk-conservative viewpoints.

4. Complex Problem Solving: Multi-agent systems are well-suited for complex problem-solving, as they can divide a large task into smaller, more manageable sub-tasks and distribute them among agents with specialized skills. Financial trading is complex, requiring diverse data, specialized expertise, and strategic decision-making.

5. Real-World Simulation: Multi-agent systems can simulate real-world scenarios, as shown by TradingAgents mimicking the organizational structure and dynamics of a professional trading firm. This simulation enables the system to benefit from established human operating procedures.

In summary, a multi-agent system is a framework where autonomous agents with distinct roles, skills, and goals collaborate. This uses communication and debate to accomplish complex tasks, as seen in the TradingAgents framework. This approach leverages different agents’ strengths to achieve more robust, effective results than a single agent could.

TradingAgents Framework for AI Trading

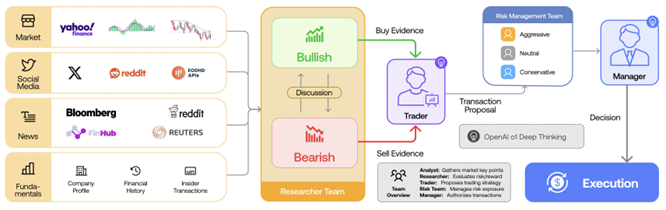

The AI Trading framework, like TradingAgents, presents a novel approach to financial trading by simulating a real-world trading firm using a multi-agent system powered by LLMs. It goes beyond single-agent systems by incorporating specialized agents with roles like fundamental, sentiment, news, and technical analysts. The analysts gather and process market data, which bullish and bearish researchers evaluate by debating investment risks and benefits.

Trader agents then synthesize these insights to make trading choices, with a risk management team monitoring exposures. This structured collaboration ensures a comprehensive analysis and informed decision-making process, much like in a human trading environment. A key feature of TradingAgents is its communication protocol, which combines structured reports with natural language dialogue.

This hybrid approach enhances efficiency by using structured outputs for control and clarity, while reserving natural language for debates that require deeper reasoning. Instead of using only natural language, agents communicate via structured documents to ensure key information isn’t lost or distorted. The framework also strategically utilizes different LLMs, employing quick-thinking models for tasks like data retrieval and deep-thinking models for complex tasks like decision-making.

The TradingAgents system also incorporates a ReAct prompting framework to synergize reasoning and acting. The system’s design enables agents to monitor a shared environment state and take context-appropriate actions, resulting in a dynamic and collaborative decision-making process. Experiments have shown that this approach improves trading performance compared to baseline models, highlighting the potential of multi-agent LLM frameworks in finance. The framework’s explainability is enhanced by the fact that the system provides natural language reasoning for its actions, allowing traders to understand and debug the system effectively.

How AI Trading Mimics Real-World Trading Firms

At the heart of TradingAgents lies the concept of replicating the collaborative dynamics of a professional trading team. Unlike many systems focusing on single-agent performance, TradingAgents simulates interactions between specialists within a trading firm. The framework includes distinct agent roles such as:

- Fundamental Analysts: Evaluating company financials, earnings reports, and insider transactions to assess a company’s intrinsic value.

- Sentiment Analysts: Gauging market sentiment through social media posts and public information to predict short-term stock price movements.

- News Analysts: Analyzing news articles, government announcements, and macroeconomic indicators to identify events that could influence market dynamics.

- Technical Analysts: Calculating and interpreting technical indicators like MACD and RSI to forecast price movements and timing entry/exit points.

- Bullish and Bearish Researchers: Evaluating the information provided by analysts, engaging in debates to assess the potential risks and benefits of investment decisions.

- Trader Agents: Synthesizing insights from analysts and researchers to execute trading decisions.

- Risk Management Team: Monitoring and controlling the firm’s exposure to various market risks to ensure trading activities remain within predefined risk parameters.

- Fund Manager: Reviewing the discussion from the risk management team, determining the appropriate risk adjustments, and updating the trader’s decision and report states within the communication protocol.

By assigning these specialized roles, AI Trading systems like TradingAgents break down the complex task of financial trading into manageable sub-tasks. This approach mirrors the way human experts collaborate in real-world trading firms, where each team member contributes their unique skills and knowledge to achieve a common goal.

Enhanced Communication and Decision Making

A key innovation of TradingAgents is its communication protocol. Many existing LLM-based agent systems rely heavily on natural language, which can lead to a “telephone effect” where information is lost or distorted over multiple interactions. To improve AI Trading, TradingAgents combines structured outputs with natural language dialogue. Agents primarily communicate via structured documents, such as reports and diagrams, ensuring that information is concise and well-organized. These reports encapsulate key metrics, insights and recommendations. Natural language is reserved for agent-to-agent debates, where diverse perspectives are integrated to enable more balanced decisions.

This hybrid approach provides both precision and flexibility, helping to enhance the decision-making process. The structured reports preserve critical information, while natural language conversations enable deeper reasoning and diverse viewpoints.

The Power of Debate

A distinctive feature of AI Trading systems like TradingAgents is their use of agentic debate. The Researcher Team includes both bullish and bearish agents, who engage in multiple rounds of discussions to assess the potential risks and benefits of investment decisions. This dialectical process allows for a more thorough and balanced understanding of the market situation, helping to identify the most promising investment strategies while anticipating potential challenges. The Risk Management team also follows a similar process with agents adopting risk-seeking, neutral and risk-averse perspectives, with the Fund Manager making the final decision.

Strategic Use of LLMs

In AI Trading, TradingAgents is designed to make strategic use of various LLMs. It employs quick-thinking models for tasks such as summarization and data retrieval, and deep-thinking models for more reasoning-intensive tasks like decision making and report writing. This targeted approach allows for an efficient and effective system, optimizing both speed and depth of reasoning. The system is flexible, enabling easy integration of new LLMs via APIs without requiring GPUs.

Experimental Results and Explainability

The TradingAgents framework has been rigorously tested using historical financial data, demonstrating superior performance compared to traditional trading strategies and baseline models. In experiments with stocks like Apple (AAPL), Google (GOOGL), and Amazon (AMZN), TradingAgents achieved significantly higher cumulative returns and Sharpe ratios. Furthermore, TradingAgents also demonstrated effective risk management, maintaining relatively low maximum drawdown figures, showcasing its ability to balance returns and risks effectively.

One of the biggest challenges with many current deep learning trading systems is their lack of explainability. These systems often make decisions based on hidden features that are difficult for humans to interpret. In contrast, TradingAgents’ decisions are communicated in natural language, providing a clear and transparent record of the agents’ reasoning, tool use, and thought processes. This explainability is a significant advantage, allowing traders to easily understand and fine-tune the framework.

The Future of AI Trading in Financial Markets

TradingAgents represents a significant step forward in the application of AI to financial trading. The framework’s ability to simulate real-world trading dynamics, coupled with its use of specialized agents, structured communication, and natural language explainability. This makes it a powerful tool for enhancing trading performance. AI Trading systems, like TradingAgents, have the potential to transform how trading decisions are made, making them more informed, transparent, and ultimately, more effective. As the field of LLMs continues to advance, frameworks like TradingAgents are poised to play an increasingly critical role in shaping the future of finance. The research paper’s authors also note that future work will focus on deploying the framework in a live trading environment, expanding agent roles, and incorporating real-time data processing.

In conclusion, the TradingAgents framework offers a glimpse into a future where AI agents collaborate and reason together like human trading teams, potentially revolutionizing the financial markets. By combining cutting-edge LLM technology with sound organizational principles, TradingAgents is setting a new benchmark for AI-driven financial decision-making.

Know more about the TradingAgents framework in this original research paper.