Introduction

In private equity, efficient and accurate due diligence is crucial to making informed investment decisions. However, traditional due diligence processes are often manual, fragmented, and time-consuming, which can delay decision-making and increase risk. EpiphAI, an AI-powered platform, automates initial due diligence processes, streamlines data analysis, and enhances decision-making, helping private equity firms improve efficiency and mitigate risk in investment evaluations.

The Problem: Overcoming Challenges in Due Diligence for PE Firms

Private equity firms often face the following challenges in their due diligence workflows:

- Manual Processes: The volume of documents and data involved in PE due diligence—such as financial statements, contracts, and market research—is overwhelming. Manual analysis of these documents is slow and prone to human error.

- Data Fragmentation: Financial, operational, and market data often exist in silos across different systems, making it difficult for PE firms to get a unified view of a potential investment.

- Regulatory Compliance: Ensuring compliance with legal and financial regulations can be daunting, especially when handling vast amounts of complex data.

- High Risks in Investment Decisions: Inaccurate or delayed insights can lead to poor investment decisions, potentially affecting returns and increasing financial risks.

The Solution: EpiphAI’s AI-Powered Due Diligence Platform

EpiphAI addresses these challenges by providing a robust, automated due diligence platform tailored to the unique needs of private equity firms. EpiphAI leverages an Agentic tool calling based framework combined with Retrieval-Augmented Generation (RAG) to power a wide range of intelligence-driven use cases for firms. The platform integrates Amazon Bedrock’s Titan Embeddings for vector-based retrieval across internal knowledge bases and crawlers for the open internet, enabling deep research capabilities. Claude models via Bedrock interpret and synthesize content to generate detailed, 4–5 pages analytical reports. The platform offers the following capabilities:

- AI-Powered Sector Intelligence: Automate the creation and continuous updating of sector packs by aggregating real-time market data, benchmarking industry KPIs, and identifying emerging trends. This ensures due diligence processes are not only faster but also enriched with dynamic, data-driven insights, reducing risks and improving investment outcomes.

- Deal Diligence: EpiphAI accelerates deal diligence by automatically analyzing financial data, legal documents, and sector-specific benchmarks to identify red flags, growth opportunities, and potential synergies. This data-driven approach enhances decision-making speed and accuracy, reducing the risk of overlooking critical deal insights.

- Data Integration and Centralization: EpiphAI integrates seamlessly with existing systems (CRMs, financial databases, cloud storage) to consolidate and centralize data, creating a unified view of the target company’s financial health, market performance, and risk profile.

- Customizable Workflows: EpiphAI’s no-code platform enables PE firms to design and automate tailored workflows that suit their unique due diligence requirements, ensuring flexibility and scalability for each investment opportunity.

- Seamless Collaboration and Reporting: With automated reports and analytics, EpiphAI enables efficient collaboration between due diligence teams, providing key insights for investment committees and stakeholders in real time.

- Continuous Monitoring Post-Investment: Beyond due diligence, EpiphAI can be used to monitor TSR performance post-investment, enabling proactive portfolio management and timely strategic adjustments.

Beyond due diligence, EpiphAI supports unstructured data extraction from diverse document types (10K, 10Q, 13F, Municipal Bonds), natural language querying and analysis on relational databases, and multi-source data fusion. AI agents coordinate between tools, APIs, and databases to deliver real-time insights, automate workflows, and support intelligent decision-making across investment, operational, and research functions.

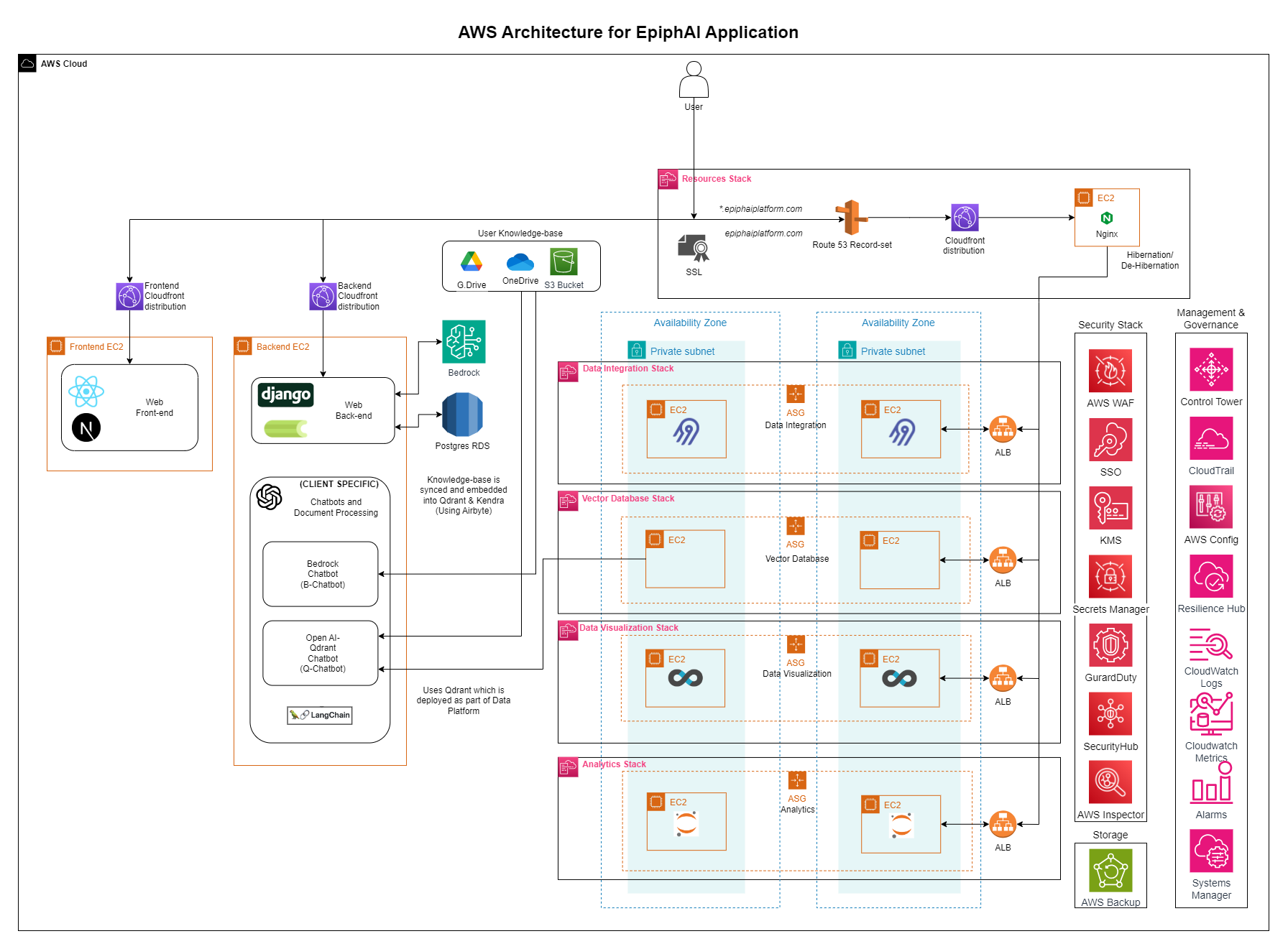

AWS Services Used

- Amazon DynamoDB: Ensures secure and scalable data storage for large volumes of due diligence data.

- AWS Step Functions: Orchestrates complex workflows, ensuring seamless integration and processing across various systems.

- Amazon SNS: Sends instant alerts about critical due diligence events, risks, or discrepancies.

- Amazon API Gateway: Enables secure communication between the EpiphAI platform and other enterprise systems.

- AWS CloudFormation: Automates infrastructure deployment, ensuring repeatability and scalability.

Results: Delivering Transformational Outcomes for PE Firms

EpiphAI’s implementation brought about powerful benefits for private equity firms:

- 70% Reduction in Time Spent on Document Review: Automation of document analysis and data extraction reduced manual work by over 70%, speeding up the entire due diligence process.

- Improved Investment Decisions: With real-time risk assessments and accurate data at their fingertips, PE firms made more informed, faster decisions, minimizing investment risks and maximizing returns.

- Enhanced Data Visibility: EpiphAI’s data integration provided a unified view of target companies, allowing PE firms to assess investments more comprehensively and transparently.

- Scalable Platform: The no-code, flexible workflows allowed EpiphAI to scale as the firm’s investment portfolio grew, handling increased data volumes and complexity effortlessly.

- Regulatory Compliance Assurance: By automating compliance checks and consolidating financial data, EpiphAI ensured that PE firms met regulatory standards without the manual burden of compliance tracking.

Conclusion: Unlocking the Future of Due Diligence for Private Equity Firms

By automating due diligence with EpiphAI, private equity firms can accelerate their investment processes, reduce human error, and ensure real-time compliance. With its AI-driven platform and seamless AWS integration, EpiphAI enables firms to make smarter, data-driven decisions and stay ahead in the competitive private equity landscape.

Next Steps: Empower Your Due Diligence Process with EpiphAI

Ready to transform your due diligence process? Contact us today to discover how EpiphAI can help your private equity firm automate due diligence, minimize risk, and drive investment success.

Contact Us:

- Email: engage@digital-alpha.com

- Phone: +1 609-759-1367